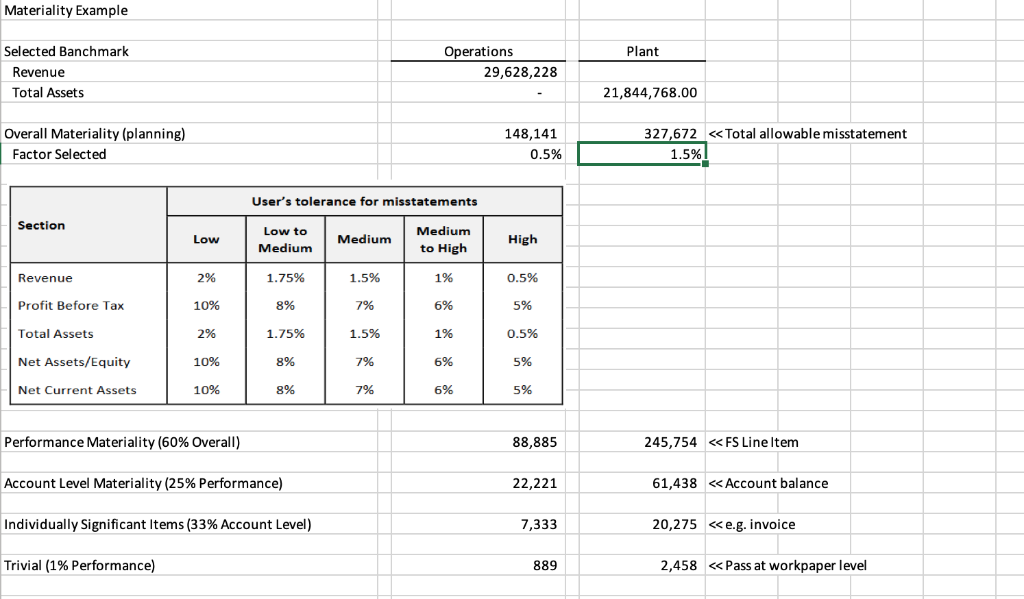

The company's revenue is recorded after a reasonable certainty exists for the receipt, while costs, losses, and contingent liabilities are recorded as soon as they occur. If the company created a plant worth Rs 250,000, 10 years ago, it should remain the same book value today. Therefore, we can conclude that all relevant information should be disclosed regarding factors that can help the user better understand financial statements Accounting Conventions with Examples For example, many companies publish their financial statements in circular figures and omit paise, and such omissions are insignificant or insignificant when the figures are in crores or lakhs. The convention of materiality enables users to disregard all events that are incompatible or immaterial objects.

In addition, the inclination of an object depends on its size, and the availability of events depends on its nature. This convention is related to the great importance of any event or object. In addition, it does not prevent any changes in accounting, but if there is a change, that change will be disclosed in the financial statements Financial Reporting AgreementĪs a rule of thumb for accounting materiality convention, an item is essential to influence users’ decisions of financial statements. The accounting conventions do not include inconsistencies, wrong calculations, other accounting mistakes, etc. Hence, we can conclude that the consistency convention is helpful in promoting accuracy, and improves comparisons, and decision-making. In addition, consolidation helps managers analyze the financial statements for the various periods and ensure that adjustment decisions are made, if necessary. In line with this, changing the accounting system can often make comparisons of different financial statements difficult for an entity. When a company decides to follow a particular accounting method, it must always follow the same procedure everywhere. In such a case, the relevant details of the event will also be disclosed. However, in the event of a financial incident occurring between the date of preparation of the balance and its publication.

The entire disclosure can be made in two ways: According to the conventions, during the preparation of the records, the accountant is required to fully disclose the financial information. The entire disclosure agreement assists the user to interpret the company's financial statements correctly. In the same way, the provision of questionable loans is also being developed. For example, inventory value is recorded at cost or a market price any less. Conservatism is a crucial convention as it is based on the premise that the future is uncertain. Now let's look at the essential accounting conventions: Consent of ConservatismĪccording to Conservatism Conventions, you should not only allocate profit against any financial transaction but also allocate the possible losses. In other words, the accounting conventions set out an accountant's guide, which assists him in preparing statements and reports. Arrangements are similar to the customs/traditions that help the auditor articulate a clear accounting picture.

Convention of Conservatism: The conference says the firm should not expect income and profit but provide for all costs and losses.Convention of Disclosure: This policy states that the financial statements should be qualified to disclose all relevant information to users to assist them in making informed decisions.However, modifications can be carried out in exceptional circumstances. Convention of Consistency: The financial statements can only be matched if the company consistently follows the accounting policies during the period.The following essential accounting concepts and conventions are presented below: To improve the quality of financial information, international financial institutions may alter or modify any accounting conventions. Accounting Conventions is a practice adopted by an entity based on a general agreement between the accounting agencies and assisting the accountant during the preparation of the Company's financial statements.

0 kommentar(er)

0 kommentar(er)